Design it. Simulate it. Perfect it.

Bring your ideas to life, faster. Our SPICE models and design simulators let you simulate real-world performance, so you can explore, refine, and perfect your designs with confidence.

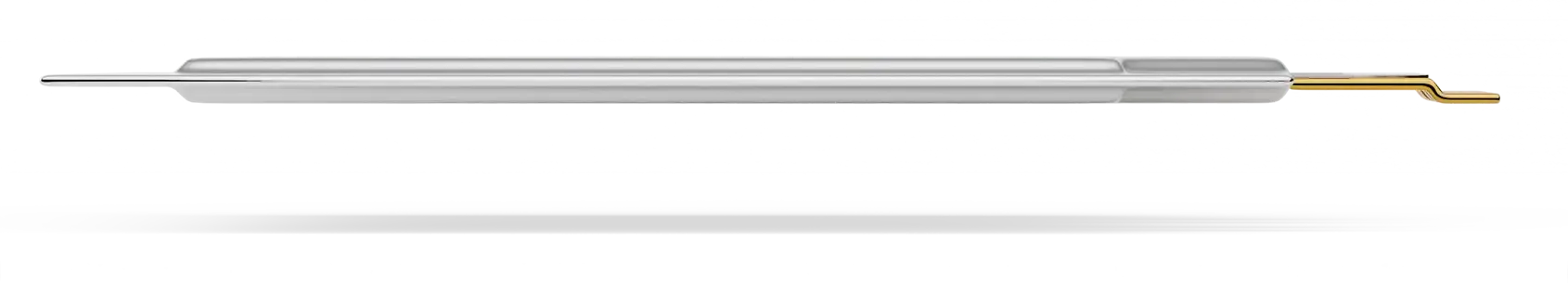

Small in size. Big in performance. Our supercapacitors combine ultra-slim form with high power output, so your innovation never has to compromise.

Ultra Thin. Ultra Capable. Ultra Fast.

High in Energy, High in Power

Power That Fits Anywhere

Performance Made Practical

Download the application for below and email to sales@cap-xx.com.

You can also contact our distributors directly for any sales enquiries. Simply choose your region below.